Permian Basin Market History: From Rollercoaster Rides to Resilient Recovery

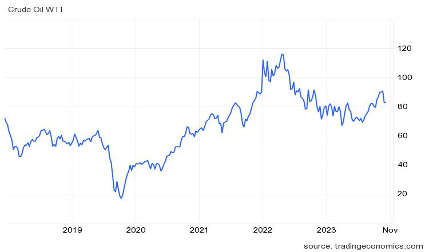

It is a given that a market like the Permian, with demand so heavily influenced by the price of a barrel of oil, will see heavy fluctuations in all performance metrics. Currently, with oil prices having steadily risen over the past 3 years, including large fluctuations that have moved the price of a barrel of WTI crude from the $80 level to nearly $120, demand for quality hotel rooms is rising. The graphic below, from TradingEconomics, shows the most recent history of the cost of a barrel of WTI:

REVPAR performance, and demand, for hotel rooms in the Permian Basin have closely tracked the cost of oil, as demand for oil increases demand for lodging. Over the past nine years, the Permian Basin Counties[1] had an annual 3.5% increase in demand, an annual increase of 1.6% in total room revenues, and a 3.7% annual decrease in REVPAR; note that market interruptions like the recent Covid pandemic are reflected in these results, with a large negative impact. Occupancy was up down the nine years, by 1.9% annually. Supply increased by 5.5% per year, with room rates falling 1.9% annually. The severity of the 2020 COVID-19 pandemic was such that it pulled down even 9-year averages.

Over the past four years, demand rose 1.7% per year, coupled with supply increases of 5%. Revenues over this period fell an average of 8% per year, while REVPAR fell 12.3% annually. Room rates fell 9.5% on average and occupancy was down 3.1% annually for the period. With the market peaking in mid-2019 (over $100 average REVPAR), a downward trend in all measures was inevitable.

Moving into the performance of the past two years, with a strong recovery in full swing, demand rose an average of 27.3% annually, while supply still rose by 8.2% per year. These results caused occupancy to increase by 17.9% annually. REVPAR rose 27.1% per year, based on rates increased 8% per year, as yearly revenues rose 37.2% annually.

Most recent history, the 12 months ending June 30, 2023, shows strong demand (+26.4%) in the market, in keeping with expectations that higher oil prices will bolster an already recovering level of demand for hotel products in the area. Revenues rose 38.6%; occupancy rose 21.9% as supply rose by 3.6%; REVPAR rose a very strong 33.8% for the average hotel room.

[1]. Counties of Andrews, Borden, Crane, Dawson, Ector, Gaines, Glasscock, Howard, Loving, Martin, Midland, Pecos, Reeves, Terrell, Upton, Ward, & Winkler. Hotels only.

Source Strategies Hospitality Industry News

The latest developments from Source Strategies about the Texas Hospitality Industry.